Optional Depend On Wikipedia

페이지 정보

본문

Any kind of properties that are within the optional trust fund belong to the trust just. Although the properties aren't subject to IHT in the recipients' estates, it is very important to include that the depend on may be subject to pertinent property regimen charges. Due to the fact that the properties continue to be outside the beneficiaries' estates for Inheritance tax objectives and are therefore not consisted of in calculating means-tested benefits. Mattioli Woods is illegal or tax obligation advisors and prior to developing a discretionary trust fund like it is essential to take advice from an expert solicitor in this field. Trust funds require to be registered with the Count on Registration Solution and this is a more area where trustees would certainly be important to seek professional recommendations to make sure compliance with these brand-new rules.

Any kind of properties that are within the optional trust fund belong to the trust just. Although the properties aren't subject to IHT in the recipients' estates, it is very important to include that the depend on may be subject to pertinent property regimen charges. Due to the fact that the properties continue to be outside the beneficiaries' estates for Inheritance tax objectives and are therefore not consisted of in calculating means-tested benefits. Mattioli Woods is illegal or tax obligation advisors and prior to developing a discretionary trust fund like it is essential to take advice from an expert solicitor in this field. Trust funds require to be registered with the Count on Registration Solution and this is a more area where trustees would certainly be important to seek professional recommendations to make sure compliance with these brand-new rules.An Overview To Asset Defense Trusts

This takes place on every 10th wedding anniversary of the trust fund until every one of the assets of the count on have actually been distributed to the beneficiaries. Organization Building Relief (BPR) and Agricultural Residential Property Alleviation (APR) can be subtracted to come to the chargeable value. Gerry dies 4 years after making a ₤ 60,000 gift into an optional depend on. The gift of ₤ 60,000 and the presents made within the 7 years before death do not exceed his readily available NRB on fatality.

Can I Include An Optional Depend My Estate Plan?

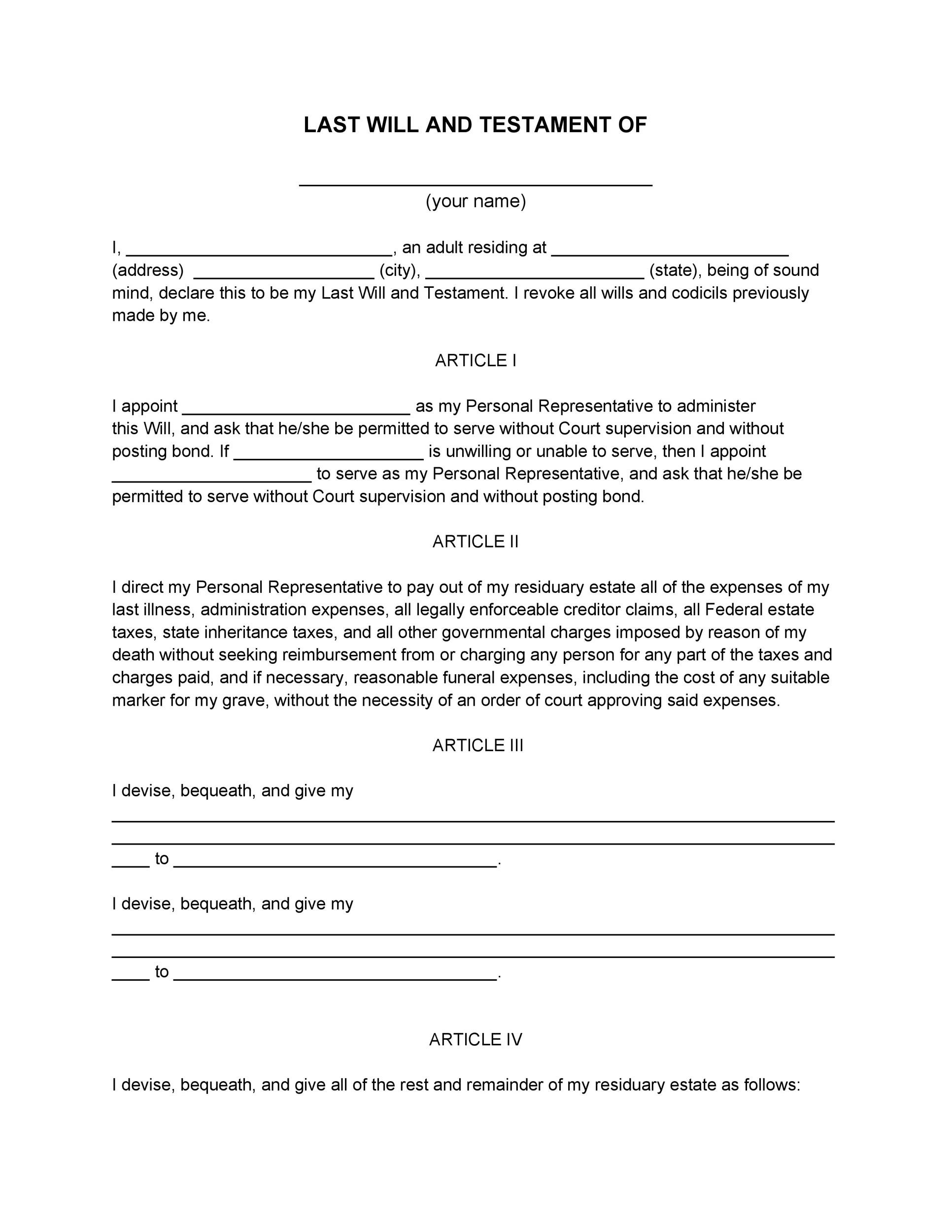

Writing a will certainly by yourself is feasible, yet it's an excellent concept to hire a legal representative if your estate is complex. An oral will, such a good point which is sometimes described as a nuncupative will, is implied for individuals who are also harmful to finish a composed or keyed in will. Lots of states don't approve these types of wills, yet those that do frequently require enough witness communication.

Before a probate will refine your estate, it's most likely to call for the presentation of your original will. If you put your will certainly in a bank secure down payment box that just you can access, your family may require to obtain a court order to get it. A water resistant and fire resistant secure in your residence, or an on the internet"paper vault" are good alternatives. Just ensure that your administrator or various other relatives have actually the called for This Web page account numbers and passwords. The very same is true for all of your electronic accounts. Your attorney or someone you trust ought to keep signed copies in instance the original will certainly is damaged. The absence of an original will can complicate matters, and without it, there's no assurance that your estate will certainly be resolved as you desire.

An online Living Will certainly manufacturer solution is a middle-ground that will certainly result in a legally binding document at a lower expense than employing an attorney. Even if this is done unintentionally, this oversight indicates the household and the Estate Planners could be revealed to the expenses, delays and anxiety of taking legal action to resolve the scenario. Beyond the fundamental preparing of a Will, there are a couple of usual errors some people make within this area of planning. Thus, taking the suitable steps to put a legitimate Will in position is a fantastic starting point, yet people also need to ensure it properly reflects desires and intents in the most efficient way.

Known as a joint will, this instrument is a single will signed by both partners. In the event of the initial partner's fatality, the staying partner may not make any modifications to the will. Mirror wills enable each spouse to guide residential property and properties to the various other spouse in case of their fatality. Afterwards, the enduring partner might change their will as their circumstances transform.

Similarly, this shields the cash in the depend on from financial institutions because a lender or various other claimant can not connect a right to existing or future cash that has not been dispersed to the recipient. Within a discretionary depend on, you can supply details guidance to the designated trustee regarding when distributions may be made. Due to the discretionary nature of the count on, there requires to be more than one optional recipient. There can additionally be a course of individuals that are assigned as the discretionary beneficiaries i.e. children or grandchildren.

Similarly, this shields the cash in the depend on from financial institutions because a lender or various other claimant can not connect a right to existing or future cash that has not been dispersed to the recipient. Within a discretionary depend on, you can supply details guidance to the designated trustee regarding when distributions may be made. Due to the discretionary nature of the count on, there requires to be more than one optional recipient. There can additionally be a course of individuals that are assigned as the discretionary beneficiaries i.e. children or grandchildren.As a result, discretionary depends on can be taxing and costly to maintain if disagreements develop between a trustee and a beneficiary. Additionally, a trustee who is not acting in the best passions of the recipient could be devoting depend on fraud or otherwise abusing their placement. The normal relationship between recipients' rights and trustees' duties which emerges in taken care of counts on is missing in optional depends on. Whilst the beneficiaries will certainly have standing to sue the trustees for stopping working to meet their tasks, it is unclear that they would certainly gain by such action.

There might also be earnings tax obligation, capital gains tax and stamp task consequences to take into consideration. A vital attribute of a discretionary trust is that the recipient does not have an automated right to the assets. The trustees can hold the properties and make decisions as to appropriate things to spend the funds on for the beneficiaries. This may consist of medical treatment, education and learning, holiday accommodation, an automobile, instructional materials such as publications, school journeys, computer devices and travel. The capital properties can be retained and made use of to produce an earnings for the beneficiaries. A discretionary depend on is a typeof depend on that is set up for the benefit of several recipients.

As a discretionary discounted gift depend on, there are no named recipients, simply a checklist of pre-determined people and various other legal entities who might beome a beneficiary. Note that the price computation is based on life time rates (half fatality rate), also if the trust was established under the will of the settlor. The rate of tax obligation payable is then 30% of those prices appropriate to a 'Hypothetical Chargeable Transfer'. When analyzing the cost suitable when funds are dispersed to a beneficiary, we require to take into consideration 2 situations.

- 이전글Най-скъпият в света гъбен трюфел 25.03.25

- 다음글Comparing The Advantages Of Sermorelin Vs Ipamorelin Vs Tesamorelin 25.03.25

댓글목록

등록된 댓글이 없습니다.